Dear user,

Thanks to your suggestions, AMI Project continues to grow.

We are pleased to introduce 3 new features:

1/ Maximum article quantity

We've increased the maximum number of articles you can register to 9,999,999, compared with 9,999 previously. This enhancement gives you greater flexibility in managing your data.

2/ Import of KBC account statements

You can now import KBC account statements into AMI Project, offering more complete integration and simplified management of your financial data.

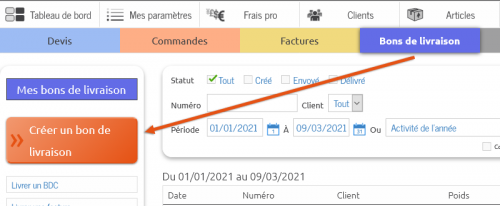

3/ Filtered exports

We've optimized the export functionalities (CSV, PDF, and print) to match your current selection, specified by the search filter and tags.

Clearer and simpler:

you export what you see.

Please do not hesitate to continue to send us your comments and suggestions. Your feedback is essential to help us constantly improve our platform.

AMI Project, online with you!

20240426103636

Display fullscreen

Dear users,

An update concerning your data

In order to continue providing you with the best possible service, we are implementing a new policy regarding the permanent storage of your data.

What will change?

From

March 31, 2024, users who have not logged in to their scoreboard for

more than 2 years will have their account deleted.

Who is affected?

This automatic rule will only apply to free accounts that have been inactive for more than 2 years.

How can you be sure your data won't be deleted?

It's very simple: log in to your AMI Project account at least

once every 2 years.

So if you haven't logged in since March 31, 2022, it's important to do so soon.

Backing up your data

If you wish to backup your data onto your own computer, please consult the help section :

AMI Project, let's stay connected

20240320122007

Display fullscreen

Dear users,

As winter approaches and the days grow shorter, many of us are working well after sunset.

In order to provide you with greater visual comfort, we are introducing

"dark mode" to AMI Project.

How does it work?

By default, your account operates in

"automatic" mode, and you can switch from one mode to the other using the buttons at the top of the screen at any time.

If you wish, however, you can impose your preferred mode in your

account Settings:

- Automatic mode: dark mode is active from 8 p.m. to 8 a.m.

- Dark mode: dark mode remains active

- Light mode: light mode remains active

AMI Project, let's stay connected

20231205100441

Display fullscreen

Dear users,

Thanks to you, AMI Project continues to evolve.

We are pleased to present 2 new features:

- search by communication

- multiple deletion

Search by communication

A few months ago, we added the option of specifying a bank payment communication (structured or unstructured) on your invoices.

From now on, you'll also be able to search by this communication.

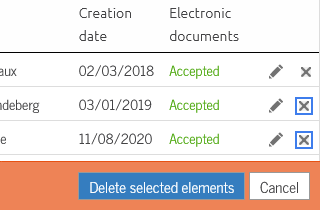

Multiple deletion

Whether you're managing customers, articles, files or accounting, you can now select several items and delete them.

Let's get connected!

20230825143427

Display fullscreen

Dear users,

In order to always bring you the best service, we have updated 2 features

1. Creation of a purchase order from a quote with options

When you will try to sign a quote with options, a new message will appear to offer you 3 choices:

- Create the purchase order (removes the options)

- Modify the quote

- Cancel

To avoid misunderstandings, it will no longer be possible to sign a quote containing options.

2. Programming the sending of an invoice

The recurring invoices tool has been given an additional option for the one-time creation of an invoice on a given date.

AMI Project, online with you

20220422204113

Display fullscreen

Dear users,

Because of you, AMI Project continues to evolve, and we thank you for that.

We are pleased to introduce

2 important new features:

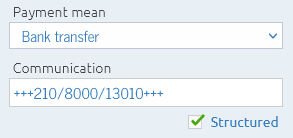

- Payment communications (structured or not)

- import of bank statements for payment synchronization

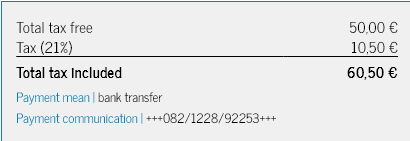

Payment communication

You can now choose to add a communication to your invoices, structured or not.

This will allow you to identify your customers' payments more quickly.

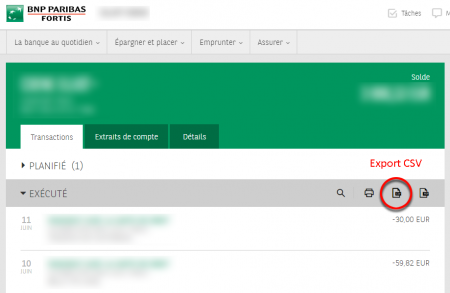

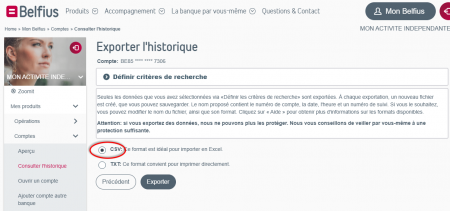

Synchronization of your bank statements

Import your bank statements in CSV* format to automatically register the payments of your invoices.

(*) The procedure to get your statements in CSV format depends on your bank.

Log in to your homebanking and look for a "CSV" (BNP Paribas Fortis) or "Export" (Belfius) button.

AMI Project, online with you

20210825144000

Display fullscreen

Dear users,

Thanks to you AMI Project continues to evolve, and we thank you for that.

We are pleased to present 2 new important features:

- delivery bonds

- purchase orders to suppliers

Delivery bonds

You can now generate delivery notes linked to a order or an invoice.

You will be able to specify the weight of each item as well as the delivery data (number of packages, shipper, tracking number, etc.).

The stock of your items will be automatically updated when a delivery note is sent.

Purchase orders to suppliers

You want to order items from your supplier? It is now possible directly on AMI Project!

Go to the "Articles" section to manage your suppliers and orders.

If necessary you can specify your delivery details.

The stock of your articles will be automatically updated when a supplier order is delivered.

More info on the articles

The weight and the purchase price of the articles can be specified, but these values can of course be modified on each of your documents.

New color code

The software is growing and so is the number of sections.

In order to make it easier for you to find your way around we have created a color code for each type of document:

- blue for quotations

- orange for orders

- yellow for invoices

- purple for delivery bonds

- gray for credit notes

- green for supplier orders

AMI Project, online with you

20210309194958

Display fullscreen

Dear users

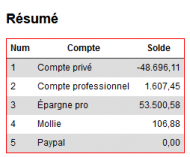

Every self-employed person must keep a treasury book in his accounting.

This book contains all the transactions carried out on your company's accounts.

Many freelancers still record it in a spreadsheet program such as Excel, which can lead to many errors.

Good news therefore, since from now on AMI Project offers you an automatic and centralized encoding!

Input transactions (business expenses) and output transactions (sales invoices) will be automatically added.

For the others (payment of the VAT statement, transfers between your accounts, ...) you can of course add them manually.

At the end of the year, export your summary to print it or save it for your tax return.

AMI Project, online with you!

20200828175226

Display fullscreen

Dear users,

A new feature is born following your suggestions!

From now on, you will be able to

classify your articles by category in order to find them more easily.

AMI, let's make business life easier!

20200414083810

Display fullscreen

Dear users,

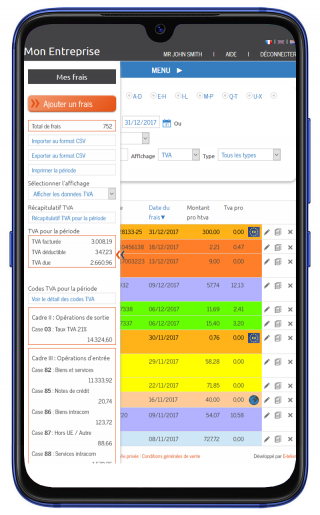

More and more of you are taking AMI Project everywhere with you and we thank you for that!

In order to make it easier to use the software on small screens we have developed a new presentation of the menus and tools.

The toolbar can be shown or hidden with a single click.

The new menu bar allows you to navigate between the various sections

AMI Project, online with you

20200121171046

Display fullscreen

Dear users,

2 new features have been added following your suggestions!

Your suggestions continue to grow AMI Project and we thank you for them.

1. Collaborator accounts

Would you like to give an collaborator access to part of your AMI Project account?

You can now add your collaborators in the "My Settings > Manage my collaborators" section.

2. Your documents in Dutch

Some of your customers are Dutch-speaking and you would like to send them your documents in their language?

Your documents can now be saved in Dutch!

With AMI Project, let's make business life easier!

20191011102634

Display fullscreen

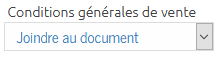

Dear users,

A new feature comes out of your suggestions!

From now on you will be able to

integrate your general conditions directly into your PDF documents.

How to?

When editing your document simply select the value "

Attach to Document" in the left menu.

Keep in mind that you can add your general conditions as a file or as text in the section "Set my documents".

AMI Project, let simplify the business life!

20190819142939

Display fullscreen

Dear users,

Your suggestions continue to improve AMI Project and we thank you for it.

It is therefore with pleasure that we present

3 new features:

1. History of articles

Do you wish to see the sales history of your articles?

This is now possible thanks to the

"Print" button in the list of articles!

2. Prices awarded to customers

Do you want to keep track of the price awarded to a customer?

This is now possible thanks to the drop-down menu

"Search for an article"!

The last articles sold to your customer are selectable below the standard items, under the mention "Latest Articles for ...".

3. Automatic acceptance or rejection of quotes

You want your customer to accept or reject your quote automatically?

Add now the acceptance and refusal links in the email sent to your client

thanks to the new 2 buttons in "

Personnalize my emails".

Note: An accepted quote creates and automatically sends the purchase order to your customer.

With AMI Project, simplify business life!

20181123152232

Display fullscreen

Dear users,

Your suggestions continue to improve AMI Project and we thank you for it.

It is therefore with pleasure that we present 2 new features:

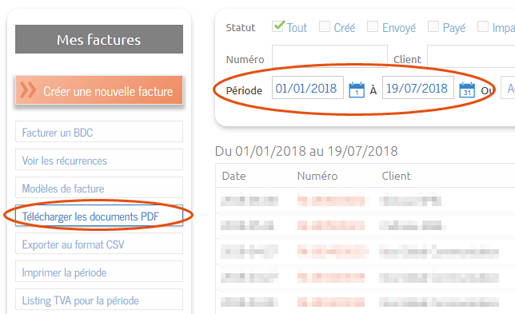

1. Downloading your documents

You want to download all documents in PDF format for a given period?

It is now possible thanks to the button

"Download documents"!

Select the period, click the button, and receive a ZIP file containing all PDF documents.

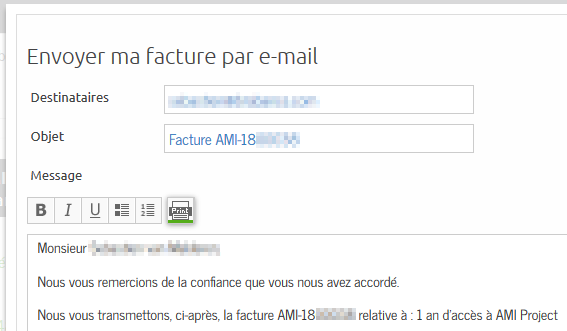

2. Printing emails

Do you want to print communications for your customers?

The

"Printer" button appears now in all contact forms!

Useful to send your invoice reminders by mail, or simply keep a paper trail of your contacts.

With AMI Project, simplify business life!

20180719111122

Display fullscreen

Dear users,

Your suggestions continue to grow AMI Project and we thank you.

It is therefore with pleasure that we present

a new feature:

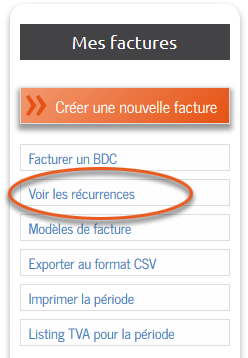

Invoice recurrences

You wish to

regularly bill your clients based on a predefined model ?

It is now possible!

Add an

invoice recurrence, defined by :

- a model

- your client

- the period (weekly, monthly or yearly)

- the first execution date

The invoice will be created and added automatically to your account.

If you want it to be sent as well, check the box and make sure your client has agreed to receive your electronic documents.

NOTICE :

This feature is reserved for users with unlimited invoices (1 year access).

With AMI Project, let's simplify business life !

20170921111114

Display fullscreen

Dear users,

Your suggestions continue to help AMI Project grow and we thank you.

It is therefore with pleasure that we present

3 new features:

1. More about your customers

You may wish to

keep useful information related to your customers (references, customer number, license plate, contact person, ...), it is now possible!

Two new boxes are available in the customer form:

- Published info: they will appear automatically on the documents in the \"notices\" box

- Unpublished info: they will only appear on AMI Project, for your internal use only

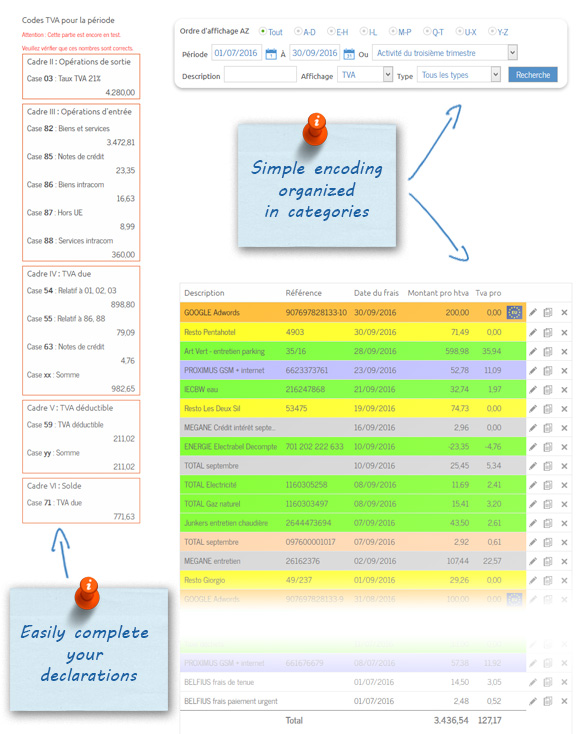

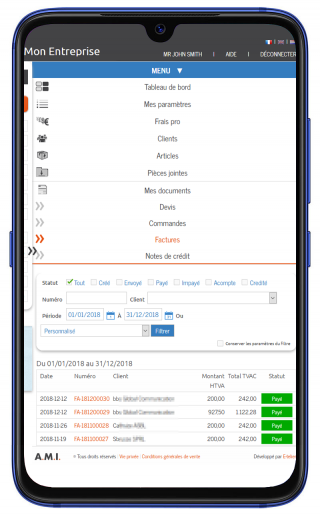

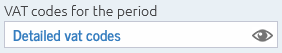

2. Detail of VAT return codes

Users who are subject to Belgian VAT can now

consult the data that is hidden behind the VAT return codes.

This will allow you to verify your encodings more easily by yourself, or through an accountant (in case of doubt we will always advise you to consult a professional).

3. Editing your documents

It is now possible to change the date and the client on a document.

WARNING: this function must be used with caution since mis-manipulation could distort your accounting (date prior to declaration, VAT regime of the customer, etc.)

With AMI Project, let's simplify business life !

20170816123413

Display fullscreen

Dear users,

Your suggestions continue to grow AMI Project and we thank you for it.

We are therefore pleased to announce the release of our latest update.

This is intended for

all our users who apply rounded tax included prices or whose clientele consists of individuals.

1. Encoding the price of your items VAT included

To ensure a

correct rounding, a rounded price or ending with ".99", you can directly encode the tax included unit price of your items.

The price excluding VAT and the amount of VAT will be calculated automatically in compliance with the legal requirements.

The tax included unit price can be encoded in the articles manager, or directly for each lines of your documents.

2. Customizing the display of your price on your documents

The "Customize Your Documents" section has a new box to display the total tax included of the lines.

With AMI Project, simplify business life !

20170427103348

Display fullscreen

Dear users,

Thanks to your suggestions AMI Project continue to grow !

It's our pleasure to introduce to you

2 new features :

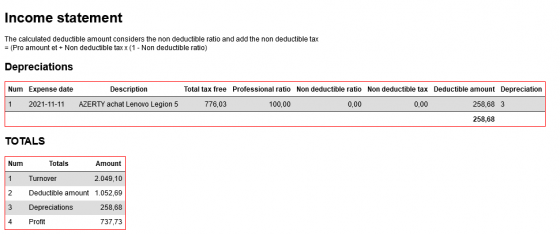

1. Accounting depreciation

Above a defined amount (250 € in Belgium), the professionnal expenses have to be depreciated in several years.

No need for complicated tables anymore,

just input the number of years of depreciation inside the expense form and AMI will take care of all the calculations for the yearly deductions (visible in the taxes estimate and the accounting results).

The depreciation duration depends of the object and the usage you'll make of it.

In general most accountants use standard durations, such as :

- new vehicle : 5 years

- Used vehicle : 3 years

- computer: 3 years

2. Reminder for multiple unpaid invoices

Some of your clients may need some reminders and until now you had to send one for each of your unpaid invoices one at a time.

To make you win some time, it it now possible to send

only one reminder for every unpaid invoices concerning the same client.

Notice : to send your reminders by e-mail your client need to accept your electronic sendings first.

Together with AMI Project, let's simplify business !

20170317102323

Display fullscreen

Dear users,

Your suggestions help AMI Project to grow and we thank you for it.

It's our pleasure to present to you

3 new features :

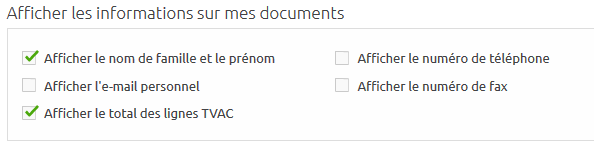

1. Personnalisation of your informations displayed on your documents

In the "Personnalise your documents" section appears a new form allowing you to

select the useful informations to be displayed in your documents footer.

Notice : for the individual businesses your name is legally required to appear next to your company's.

2. Automatic cocontracting rule

The

business subjected to the cocontracting rule (construction, gardening, ...) can now declare it in the company's informations.

The cocontracting rule (0% VAT rate and legal notice) will be applied automatically to your documents if you select a professional client.

Of course, you could always change it yourself if it doesn't suit your needs.

3. Intracommunity rule

For every

intra-Europe document, the intracommunity rule (0% VAT rate and legal notice) will be applied automatically to your documents if you select a professional client.

Of course, you could always change it yourself if it doesn't suit your needs.

Together with AMI Project, let's make the business world easier !

20170303123849

Display fullscreen

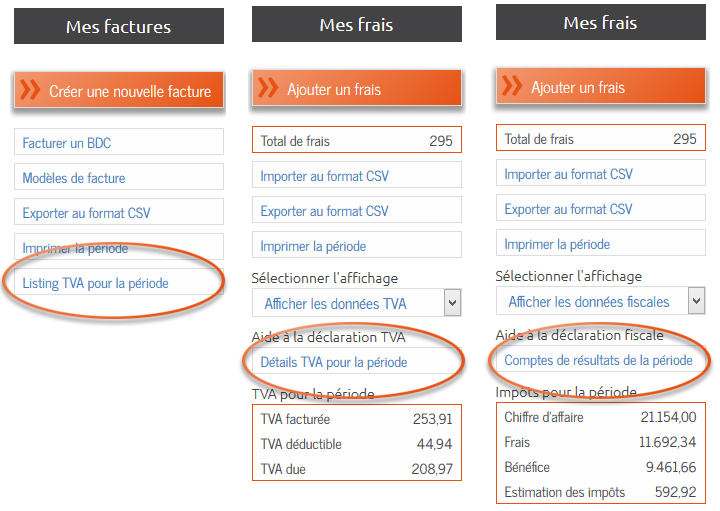

Dear users subject to VAT,

The

yearly listing for clients subject to VAT is to be sent before

March 30.

It's time to discover our new VAT listing tool !

- Where : on the Invoices page

- When : select the period "Last year activity"

- How : click on the "VAT Listing for the period" button in the left menu

Still more tools to help you with your statements

2 new buttons appeared on the "Professional expenses" page :

- The VAT details

- The Income statement for taxes

Thanks to you, AMI Project keeps on growing, thanks !

Regards

AMI's team

20170224103625

Display fullscreen